Once in a while, while chatting with friends with school-aged kids, the topic of allowance comes up. “How do you guys do it?” we’re asked. We aren’t financial gurus by any means but we do have a little system in place that will hopefully instill some basic financial sense in our children.

Our system is based partly on how Tim’s dad (former accountant) taught Tim, and partly on a short, practical book called, Money-Smart Kids: Teach Your Children Financial Confidence and Control (affiliate link). Each family needs to tailor the way they approach the subject to their context, but today we’ll share what we do. Hopefully it can give you a starting point.

Why Allowance?

The first question we had to figure out as parents was whether or not to give allowance. What were the merits of handing over money to our children on a regular basis? What would be the parameters surrounding it? Would they get paid for chores?

For us, we decided that our kids would not get paid for doing chores. Pitching in around the house was an expected part of living as a family and sharing a space. Chores were also teaching them skills for that day when they live on their own and will need to do their own laundry, sweep the floors, and clean the bathrooms – things no one will pay them for.

Our first reason for giving allowance was that it was a way for our kids to learn how to handle money in small amounts while they were young so that eventually they would have the skills and wisdom to handle larger amounts. We would rather see them make a $20 financial mistake as kids now than later when what’s at stake might be in the hundreds or thousands. Allowance would be a way for them to learn money management and grow in discernment about what things are worth.

After reading Money-Smart Kids, my vision was expanded. Gail Vaz-Oxlade suggests seeing allowance as giving your kids a portion of the household budget to manage. Begin them young with a small portion, and as they get older, increase their responsibilities. So when they’re 6, for example, they’re in charge of managing the portion of money that would go toward those little things kids usually ask for; incidentals such as stickers, craft supplies, origami paper, and candy. By the time they’re 16, they can be responsible the little things as well as managing the portion of money that is allotted for their clothing. For example, Tim’s allowance when he was a teenager included money for transportation, clothing, shoes, and lunch. In Vaz-Oxlade’s book, she even goes as far as teaching them about credit cards by running your own household credit system. We haven’t gotten that far, as our kids are still in primary school, but the vision for financial education that she paints is long-term and comprehensive.

What Age Do You Start?

For allowance to make sense, we thought our kids needed to know basic addition and subtraction, along with how to write all their letters and numbers. Knowing the value of each type of coin and bill was also important. Tim was raised with having to keep a ledger to track all his income and expenses and those basic bookkeeping skills have served him (and our family!) well. So we wanted our kids to learn how to do the same.

We started talking about the idea of allowance with our older daughter when she was 5 years old. The big day came when she turned 6 and received her allowance book and her first $5. We agreed that allowance day would be every Saturday, and that before she could take out her allowance book and money, she had to make sure her desk was clean so that she’d have space to write and count the money.

With our second-born, things happened a bit earlier (as is generally the case with subsequent children). She saw her sister getting to do things with her own money and quite naturally wanted to do the same. Since she was only 4 years old at the time, we told her that when she could write all her letters and numbers properly without copying, she could start allowance. This gave her strong motivation to work on her printing and she successfully showed us her letters and numbers when she was 4.5 years old. So we let her start a simplified allowance once a month (details explained below). By that time, she could also do the simple math required. We are planning to graduate her to the same system her sister is on when she turns 6.

Our Allowance System(s)

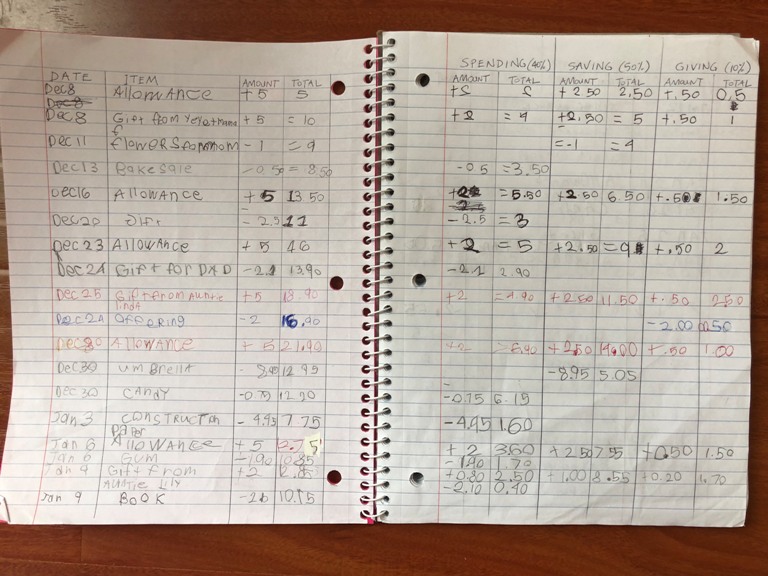

An important part of financial education to us is teaching our kids not only how to spend wisely, but also how to save and to give. So the system we set up (which our older daughter currently uses and younger daughter will use when she’s 6) starts out with a basic portioning of 10% giving, 40% spending, and 50% saving. Some parents may wish to let their kids choose the percentages but at this young age, it made more sense to have a structure in place. To make the math easier for now, we give her $5/week, which breaks down to $0.50 giving, $2.00 spending, and $2.50 saving. This amount is and has been more than enough for her so far. Eventually, we will gradually increase it as her responsibilities increase.

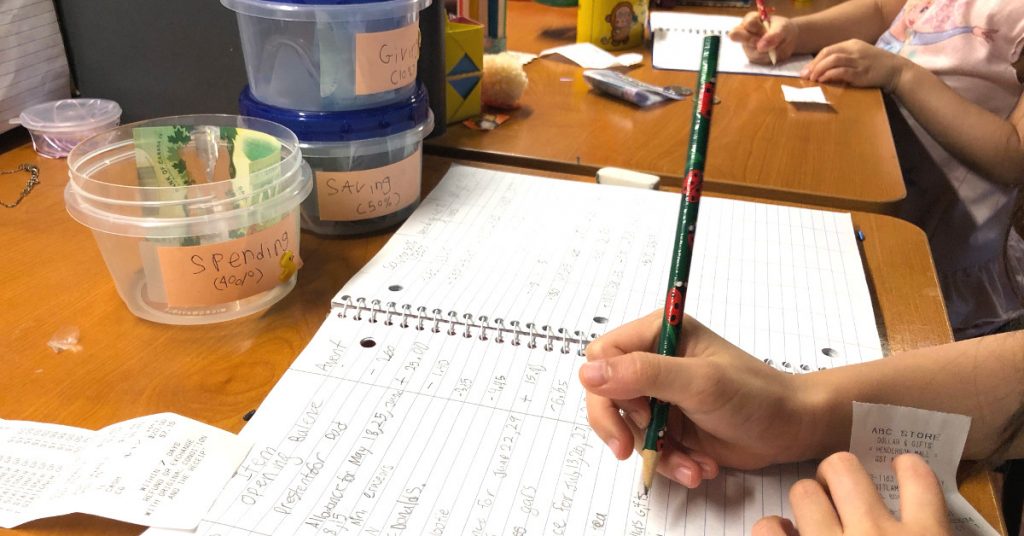

To keep the allowance, I found some Ziploc containers with screw-on lids and cut a slot in the tops so she could deposit her money in them. She has three containers, each labeled with a category. We didn’t like piggy banks because we found that she needed to have her money accessible so that she could easily count or use it. We also wanted to give her ownership of it and didn’t want her to need us to help her every time she wanted to access her money.

For the categories, it took us a while to figure out which purchases would come from spending and which ones from saving. As parents, we have money set aside for their education fund so she doesn’t need to be putting their allowance toward that, and it didn’t seem appropriate to have her saving toward a house, for example, because it’s just too abstract. What we settled on was this: The spending category is for day-to-day purchases (eg, jelly beans, tape, school bake sale treats). The saving category is for larger purchases or gifts (eg, a classmate’s birthday gift, flowers for her mom *heart melt*, souvenirs from trips). The giving category is to donate. Since we believe God has given us everything, we want to honour God through the giving of our finances to help those around us. Most of the time, the giving portion is brought to church.

On allowance day, she’ll take out her ledger and any receipts from things she’s bought since the last allowance day and she’ll record all the expenses before entering the new allowance income. After tallying the new totals, she’ll count her cash to make sure the amount matches with what’s written. Her ledger has the following columns: Date, Item, Amount, and Savings, Spending, and Giving (the last three each with 2 sub-columns: +/- and running total).

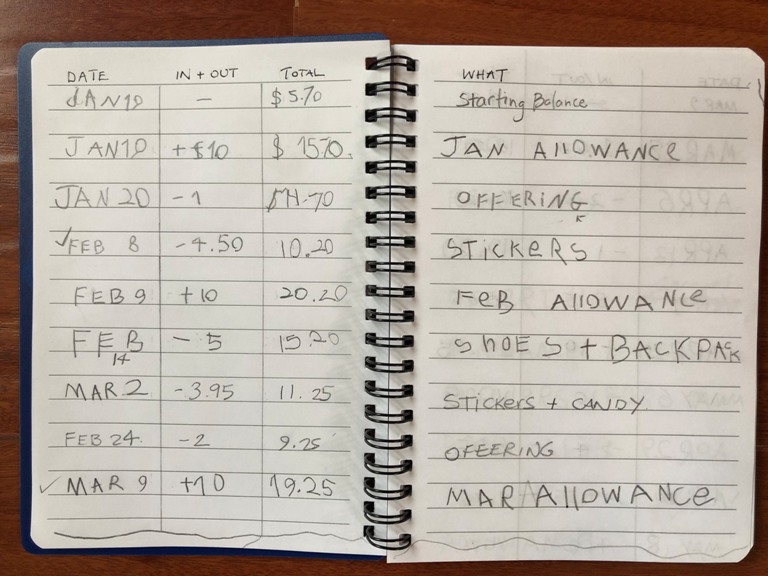

Our five-year-old gets $10/month and doesn’t divide it into three categories. She has a smaller, simpler ledger where she notes the date, whether the money came in or went out, the running total, and a description of what that item was. Similar to her sister, on allowance day, she will take out her ledger and any receipts from things she’s bought since the last allowance day and she’ll record all the expenses before entering the new allowance income. After tallying the new totals, she’ll count her cash to make sure the amount matches with what’s written.

How It’s Worked For Us So Far

At the beginning, doing allowance took up a good chunk of time because printing numbers, doing math, and writing down each item was a slow process. But over time, it’s gotten quicker. And now that our older daughter is 7.5, she can pretty much write and calculate all the entries on her own and Tim just checks them afterward. We’ve also become less consistent about giving allowance every Saturday. Sometimes we end up playing catch-up for the previous two or three weeks. Maybe it’s because our kids don’t have that much to spend their money on.

We’ve learned that Tim is better at taking them shopping because he’s less bothered by their spending choices. One time, they came back with four packs of construction paper because our daughter thought it would be more time-efficient to get them all at once. I felt annoyed because four packs seemed like overkill. But this was her learning experience, and she was right, because it’s been a loooong time since we’ve had to buy any more construction paper.

It’s been kind of fun watching our children’s personalities come through in their spending. One is definitely more of a saver and the other one spends more readily. Because we want them to develop awareness of how they like to use their money, we’ve had ongoing conversations about how satisfied they are with their purchases. We’ve also watched them feel the sting of things breaking when they weren’t careful with what they bought with their own money.

Our kids have grown a sense of autonomy; taking pride and joy in deciding what they want to get for themselves or others. They’ve become more confident in interacting with cashiers and merchants and have learned the importance of making sure they receive correct change. Last year, when one of my friends was raising money to provide shoes and backpacks for children in Bubanza, both girls excitedly went to get their allowance money to contribute to the cause.

Overall, after giving them allowance, our kids have asked us to buy them things less often because they know we would answer them, “How about you use your allowance for that?” However, as a trade off, they’ve begun to ask us to take them shopping instead!